How to file a PAPER return?

In the circumstances where a return is not accepted by NETFILE/EFILE, for instance, a final return for deceased, you may need to print and mail a paper return.

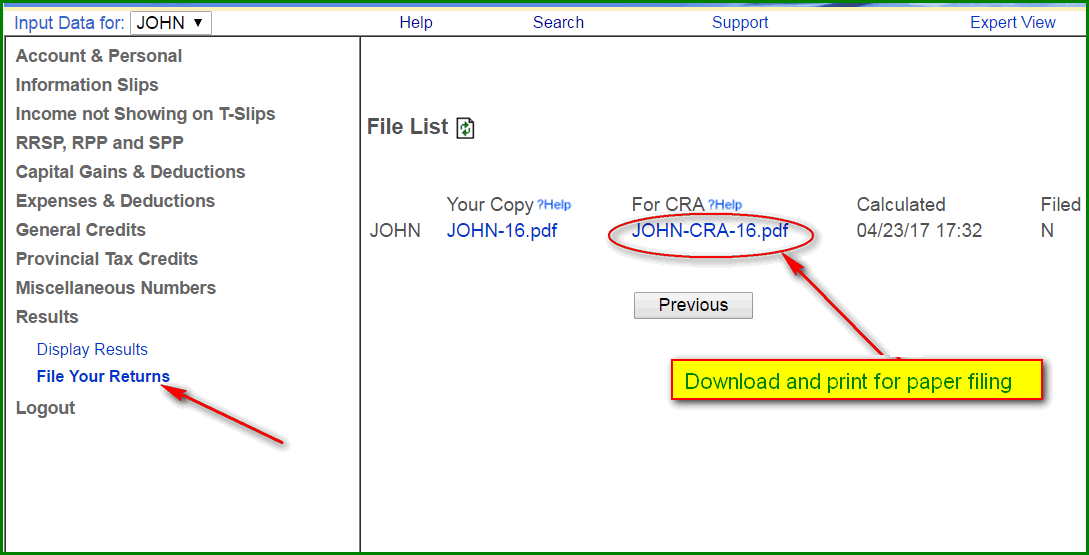

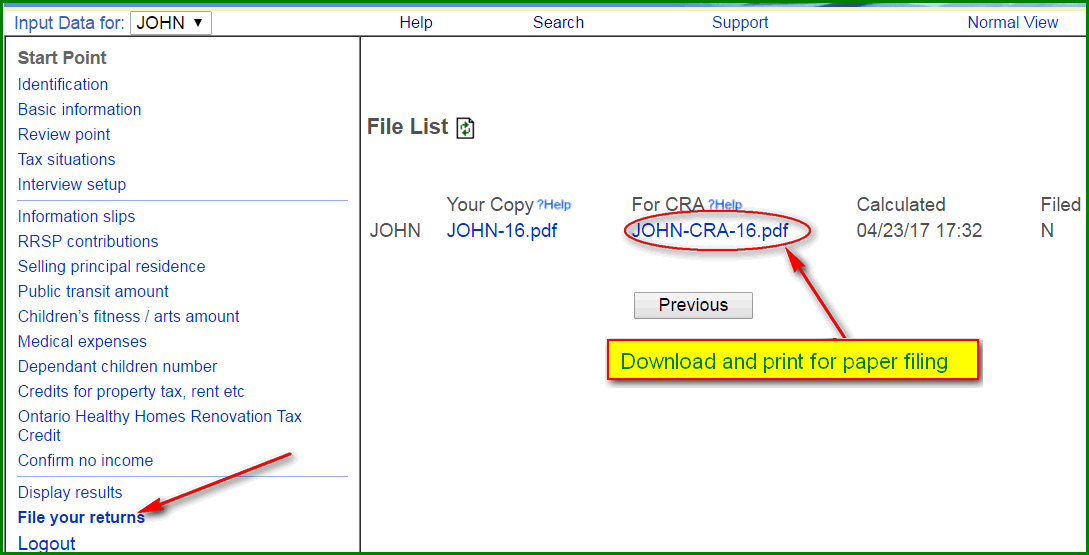

Before you go to "File your Returns" page(second picture) to download and print the return, you need to go to Submission Settings page to mark the return as paper-return.

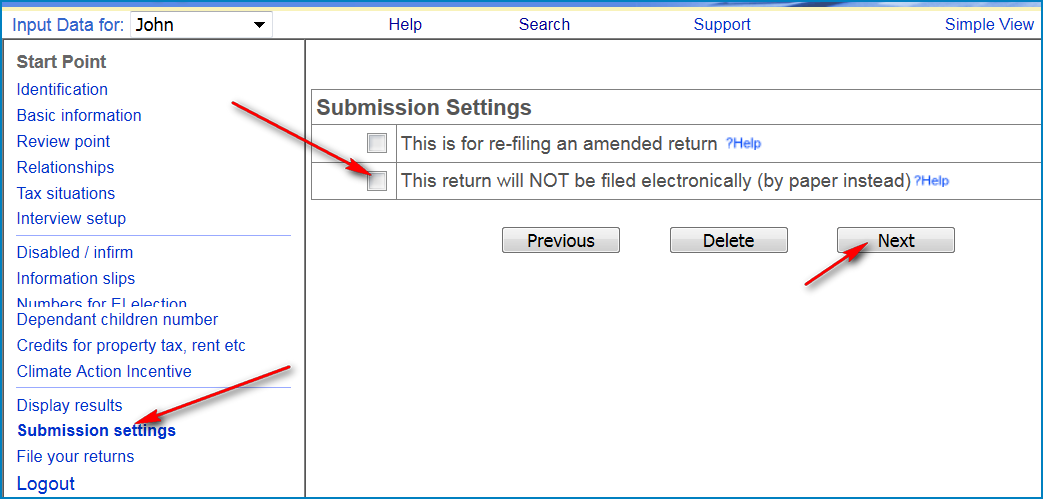

If you are in simple view

- Switch to the person you need to work on;

- Click "Submission settings" on the left above "File your returns";

- Tick the box "This return will NOT be filed electronically (by paper instead)" and click "Next";

- Then you will be able to download the CRA-required paper return (called T1-Condensed) to print.

You also need to sign the return and attach the supporting documents like T-slips. You can find the mailing address that serves your area by clicking on this: CRA ADDRESS

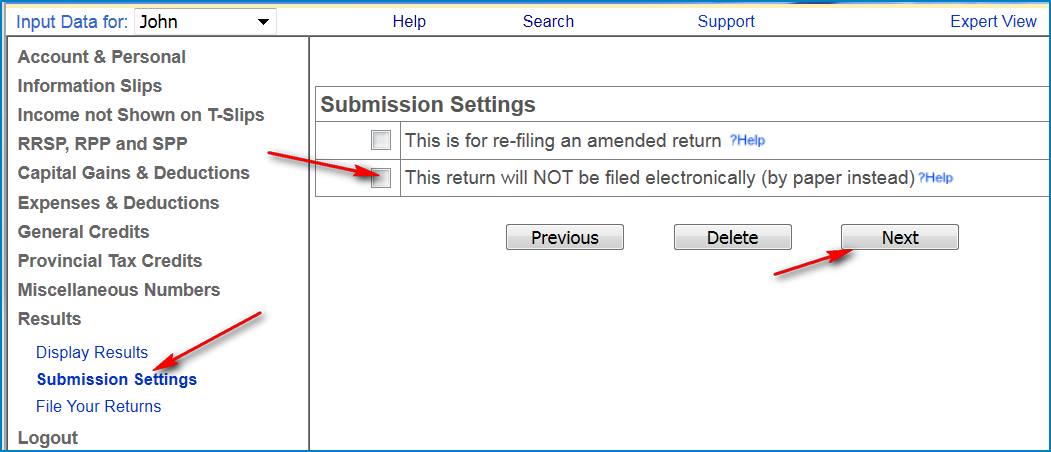

If you are in expert view

- Switch to the taxpayer's name;

- Click "Submission settings" under "Results";

- Tick the box "This return will NOT be filed electronically (by paper instead)" and click "Next";

- Then you will be able to download the CRA-required paper return (called T1-Condensed) to print.

You also need to sign the return and attach the supporting documents like T-slips. You can find the mailing address that serves your area by clicking on this: CRA ADDRESS