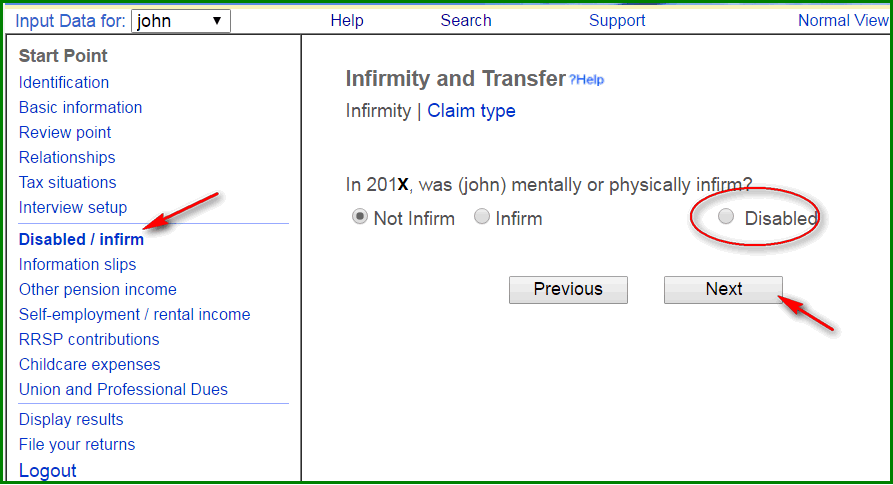

It is a simple step to claim disability credit in Taxchopper.

All you need to do - Go to "Infirmaty Status" page(shown below), select "Disabled", that's it!The system will take care of the following behind the scenes:

- claim your disability tax credit on line 31600;

- automatically transfer unused amount to spouse when apply;

- allow other family members to claim caregiver amount, infirm amount, disability transfer amount etc.How?,

You must have a CRA approved T2201 to claim this credit.

On Infirmity Status page, if you choose "Infirm" instead of "Disabled" so that for other family members to claim caregiver amount, infirm amount etc.How?, CRA may still ask for a signed statement from a medical practitioner for the infirmity.

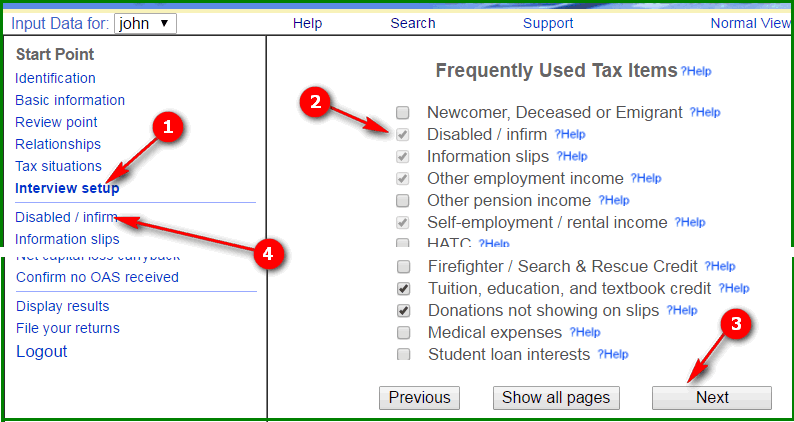

If you are in Simple view:

Click on "Interview setup" ==> check "Disabled / infirm" on the right ==> click Next at the bottom ==> click on "Disabled / infirm" on the left to get to the page.

(For someone in your account who does not need a return, a "Infirmity" link on the left is always available.)

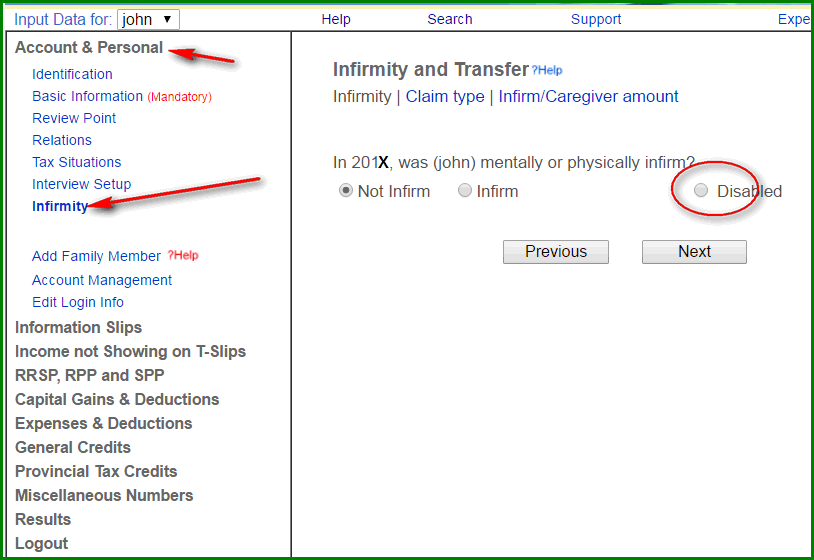

If you are in expert view:

Click on "Infirmity" under "Account & Personal" on the left to get to the page.