How to claim infirm dependants related credits?

Before you can claim infirm dependant related credits, you should have already declared the dependant as infirm or disabled under his/her own name.How?

For the spouse, NO action is needed, as long as the above is done, all related credits are calculated automatically including Canada Caregiver amount and disability transfer.

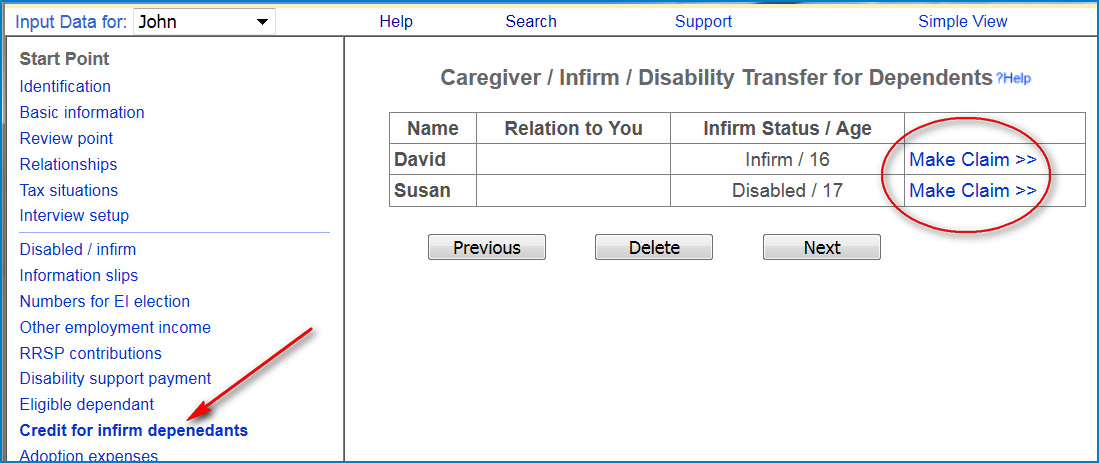

For other family members, go to the page "Caregiver / Infirm / Disability Transfer for Dependents" to claim available credits explained below.

- The supporting person can claim Canada Caregiver Amount credit. This credit will go to either line 30450 or 30500, depending on the dependent's age.

- If the infirm dependent is a resident of Ontario, Yukon or British Columbia, provincial caregiver amount will be claimed automatically based on your federal Canada Caregiver amount. Please note that Ontario/British Columbia caregiver amount credit is only for dependent age 18 or older.

- For an infirm dependent 18 years of age or older who is a resident other than Ontario, Yukon and British Columbia, the legacy infirm / caregiver amount needs to be claimed. If the dependent lived in a dwelling you maintain, you can claim a provincial caregiver amount (which tolerates higher income of dependent), otherwise you can claim the provincial infirm amount. Please note that if a senior parent (65+) lived with you, the provincial caregiver amount can be claimed even if the parent is not infirm/disabled (not the case federally).

- If the dependent is disabled (with an approved T2201 certificate), you can also claim a disability transfer if the dependent has low to medium income.

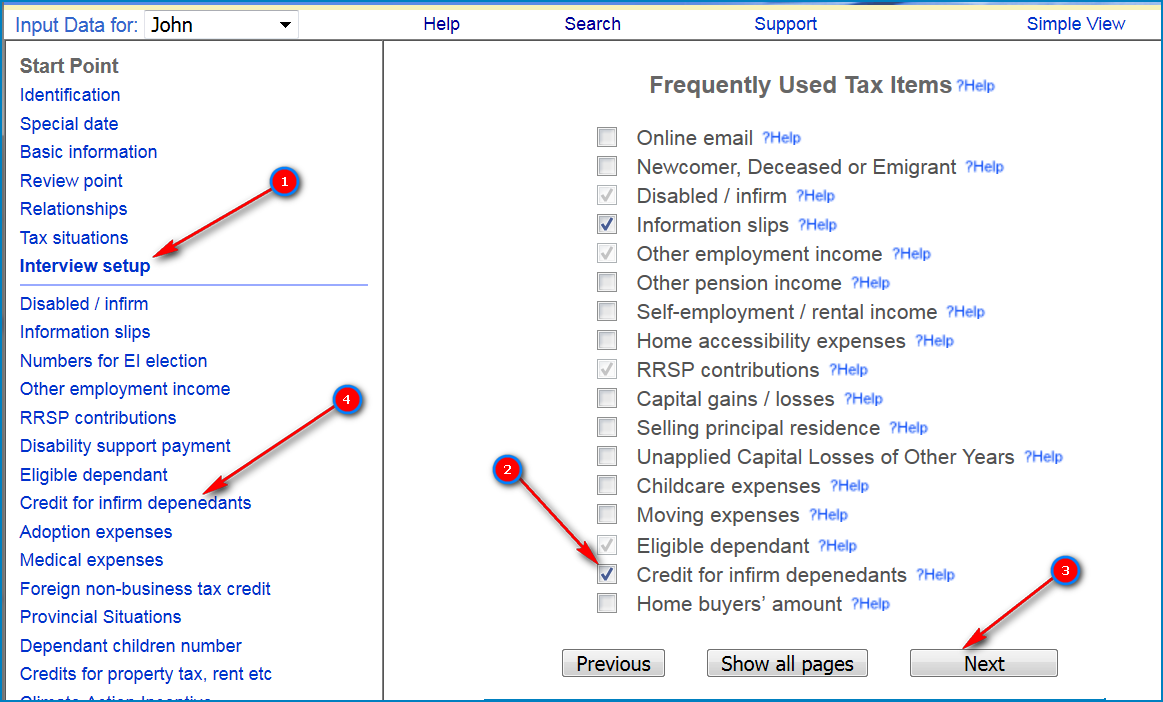

If you are in Simple view:

Click on "Interview setup" ==> check "Credit for infirm dependants" on the right ==> click Next at the bottom ==> click on "Credit for infirm dependants" on the left to get to the page.

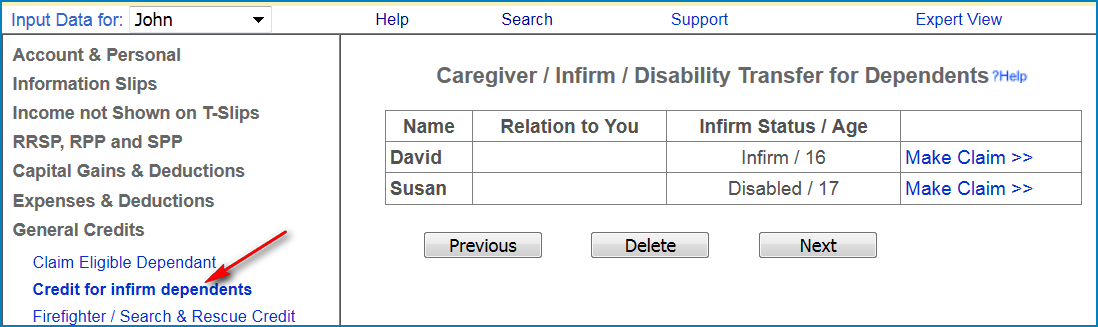

If you are in expert view:

Click on "Credit for infirm dependants" under "General Credits" on the left to get to the page.