About the return for a deceased person ?

Enter the date of death so that TaxChopper knows it is a "final" return.

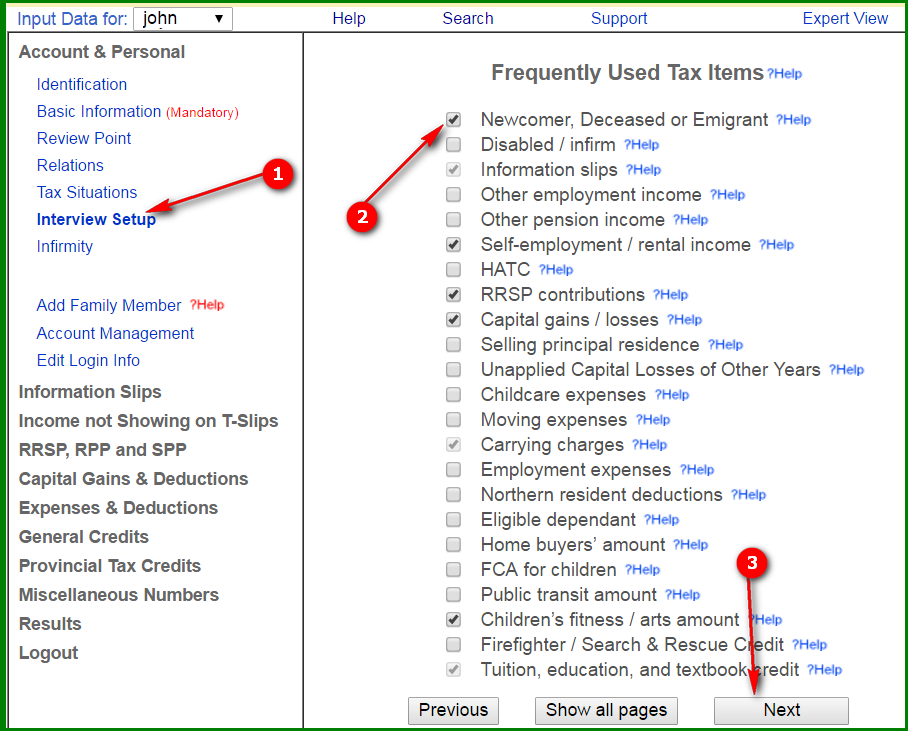

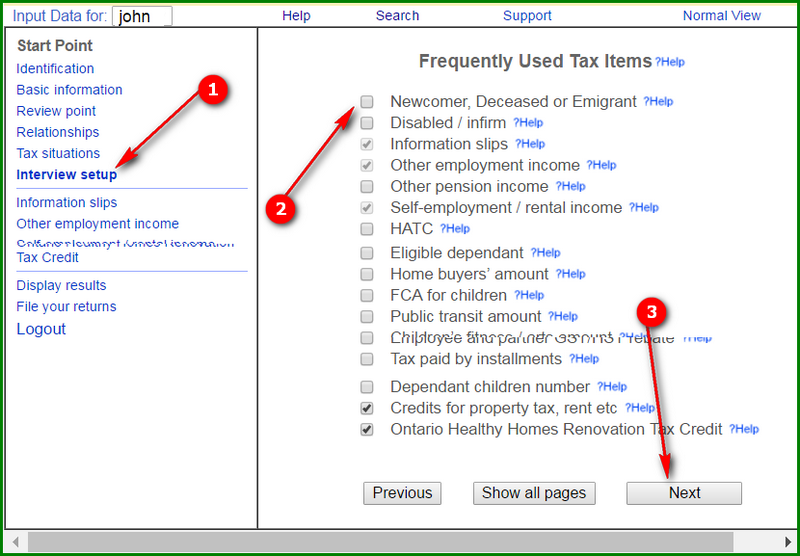

- Click "Interview Setup" under "Start Point" or under "Account & Personal" on the left.

- Tick the box "Newcomer, Deceased or Emigrant" on the right and click Next.

- Click "Special Date" on the left to get to the page, then enter the date of death and click Next.

- At the "Basic Information" page of the deceased, the marital status should be married/common-law (on the date of death, or tax year end),

also answer "No" to the question "Was your marital status changed?".

- At the "Basic Information" page of the surviving spouse, select Widowed for marital status at end of tax year, answer "Yes" to the question "Was your marital status changed?".

Note: NETFILE does not accept final returns. You need to Paper file the return instead of electronically. How to file a PAPER return?

Simple view:

Expert view: