How to enter Other Interest Income?

If you received some "other interest", for example interest from CRA, you can use a made-up slip "Other Investment Income".

Tip: If the income is from a foreign source and you have paid taxes, you can claim Foreign Non-business Tax Credit at "Foreign Non-business Tax Credit" page.

How?

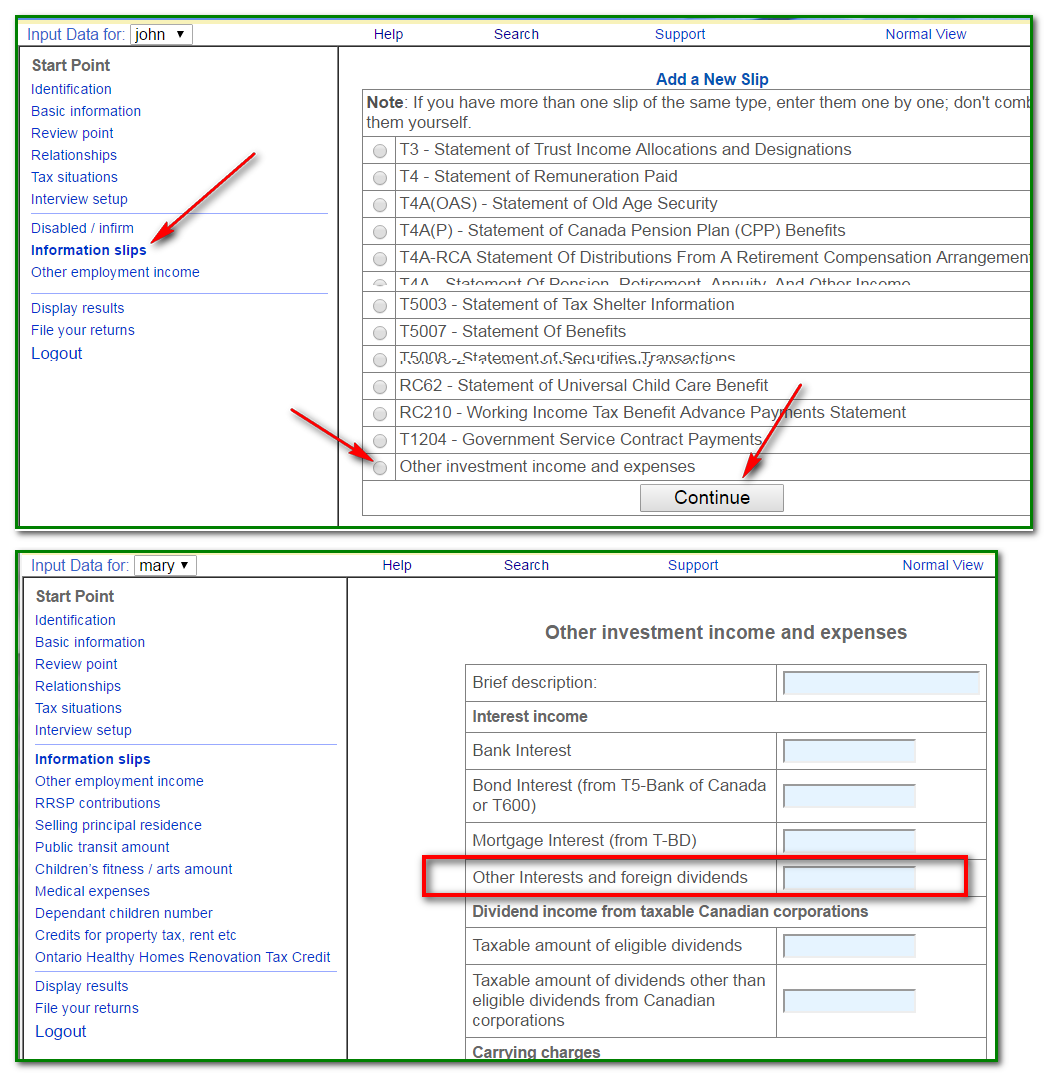

Simple view:

Click "information Slips" on the left ==> click "Add a New Slip" ==> check the very last box and click Continue.

On the next page, enter your amount in the box "Other Interests and foreign dividends".

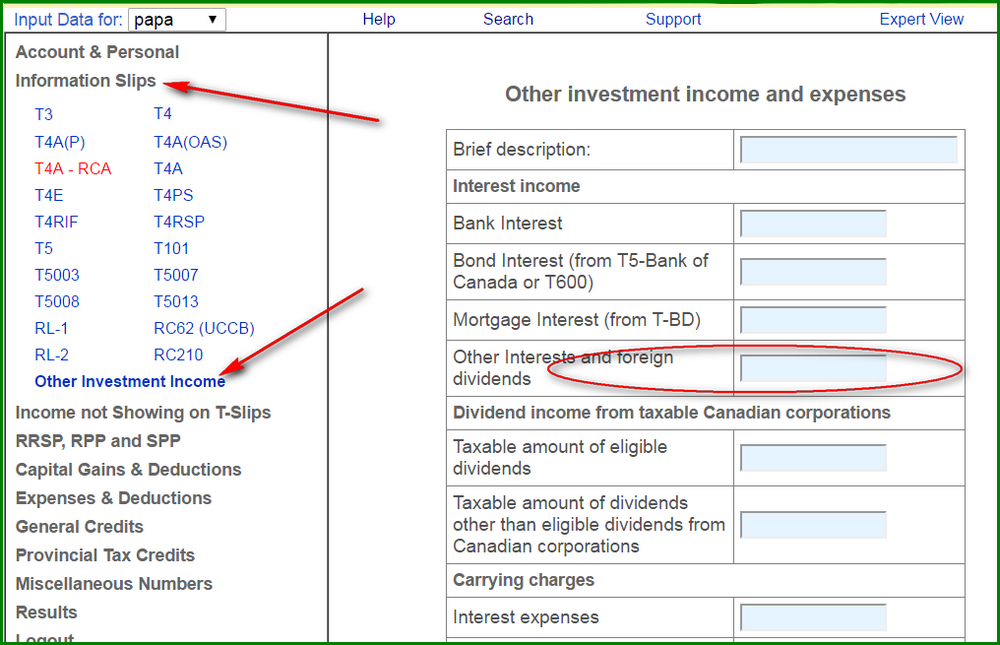

Expert view:

On the left, click "information Slips" ==> click "Other Interests and foreign dividends"

On the next page, enter your amount in the box "Other Interests and foreign dividends".